The Work Goes On

Robert Moffitt on his “rewarding” career integrating economics, sociology and public policy

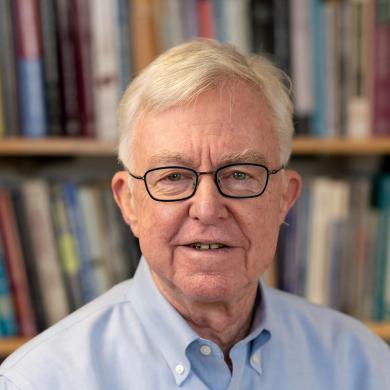

Robert Moffitt, the Krieger-Eisenhower Professor of Economics at Johns Hopkins University, discusses his early education, his interest in labor economics, applied microeconometrics, and welfare policy, and how his work has influenced major debates in public policy, especially the economics of low-income populations in the United States.

In this episode, Moffitt and Ashenfelter discuss:

- Moffitt’s upbringing in Houston, Texas, and how his parents “...put a very high value [on] education, so I had a very good set of parents to push me forward.”

- Moffitt's undergraduate education at Rice University during the late 1960s when “...the War on Poverty was going on, civil rights was going on, all kinds of interesting stuff.”

- Moffitt’s desire to pursue applied microeconomics to study real world problems and how his 1975 Brown University dissertation on urban economics examined the “mismatch” between the location of black workers and where their jobs were moving to in the suburbs, referred to as the “mismatch hypothesis.”

- Moffitt’s work on the Gary Income Maintenance experiment early in his career. This experiment in Gary, Indiana, was one of a series designed to test the effects of alternative negative income tax (NIT) plans.

- How a letter Moffitt wrote disputing the findings of a research paper published in the Journal of Economic Literature led him to an appointment at the University of Wisconsin-Madison and a life-long relationship with the Institute for Research on Poverty. “...[T]hat was really the turning point because I went out and visited Wisconsin and the Institute for Research on Poverty was there. And that's where all the NIT experiments, the original ones, the New Jersey experiment, and all the others had started.”

- Moffitt’s extensive public service work. “I've been [a] very policy-oriented guy my whole life. And this idea of going to Washington and reporting and being a scholar who knows the literature, and contributing to policy discussions has always been something I've found very rewarding.”

- Moffitt’s work on evaluating the effects of the 1996 welfare reform bill and the 2019 child tax credit, which President Biden enacted. “...[I]n 2020 what happened was Biden got elected and in 2021 he proposed the child tax credit during the pandemic. It was one of his signature themes.”

Robert Moffitt earned his Ph.D. in economics from Brown University in 1975. He is currently the Krieger-Eisenhower Professor of Economics at Johns Hopkins University where he holds a joint appointment at the Johns Hopkins School of Public Health. He is also a member of the National Academy of Sciences and has served on several government advisory committees, including recent work on the Biden administration’s expanded child tax credit. "The Work Goes On"—a podcast produced as Princeton's Industrial Relations Section (IR Section) celebrates its 100th anniversary—is an oral history of industrial relations and labor economics hosted (typically) by Princeton's Orley Ashenfelter.

- Moffitt, R., & National Bureau of Economic Research. (2002). Economic effects of means-tested transfers in the U.S. Cambridge, MA: National Bureau of Economic Research.

- Moffitt, R., & Ver, P. M. (2001). Evaluating welfare reform in an era of transition. Washington, DC: National Academy Press